This page has been automatically translated. Please refer to the page in French if needed.

Taxes

What is the tax deduction for children's education?

Publié le 22 mai 2023 - Directorate for Legal and Administrative Information (Prime Minister)

You can get a tax reduction when your dependent child is in high school (college or high school) or higher. What are the exemption conditions, what discount are you entitled to and how do you have to report? Answers with Service-Public.fr.

The card Income Tax - Children's Tuition Fees (Tax Cut) Answers all your questions about the tax deductions available based on your children's education. Also find this information with a detailed infographic.

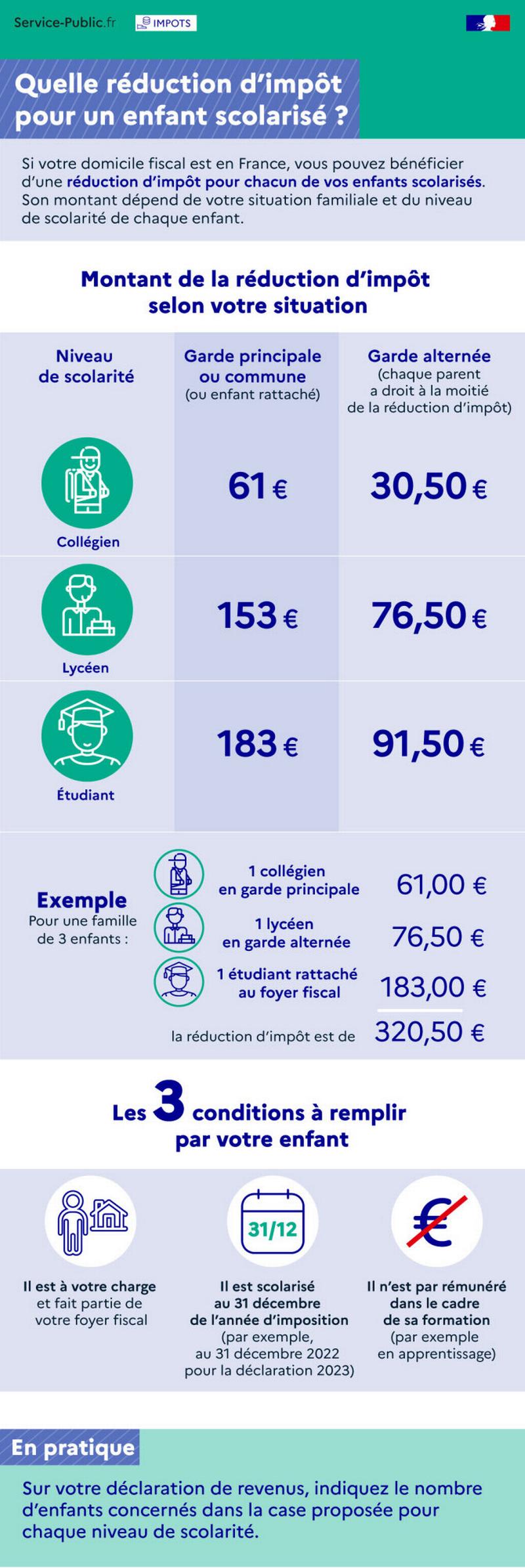

Infographie - What tax cut for a child in school?

Ouvrir l’image dans une nouvelle fenêtre

Title: What tax cut for a child in school?

If your tax residence is in France, you can benefit from a tax reduction for each of your school children. The amount depends on your family situation and the level of education of your children.

Amount of the tax reduction depending on your situation

1/ Common or main custody (or child attached:

- College student: 61 €

- High school student: 153 €

- Student: 183 €

2/ Alternate custody

- Middle-school student: 30,50 €

- High school student: €76.50

- Student: 91,50 €

Example:

For a family of 3 children including 1 secondary school student in alternate care, 1 middle school student in primary care and 1 student attached to the tax shelter, the tax reduction is €320.50 (61 + 76.50 + 183).

The 3 conditions to be fulfilled by your child in school:

- It's your dependant and part of your tax household

- He is in school as of December 31 of the tax year (for example, as of December 31, 2022 for the 2023 return)

- He is not paid for his training (e.g. apprenticeship).

In practice: On your tax return, indicate the number of children involved at each level of education.

Additional topics

Service-Public.fr

Service-Public.fr

Service-Public.fr

Service-Public.fr

Legifrance

Agenda

Du 14 avr. au 15 juin 2025

Prévention Covid-19

Publié le 02 avril 2025

À partir du 2 avr. 2025

ETA

Publié le 24 mars 2025