This page has been automatically translated. Please refer to the page in French if needed.

Taxation

Income tax: 2025 tax brackets and rates

Publié le 18 février 2025 - Directorate for Legal and Administrative Information (Prime Minister)

The 2025 income tax amount for 2024 is calculated based on scales. What are the brackets to calculate your income tax? What tax rates are applied? Service-Public.fr informs you.

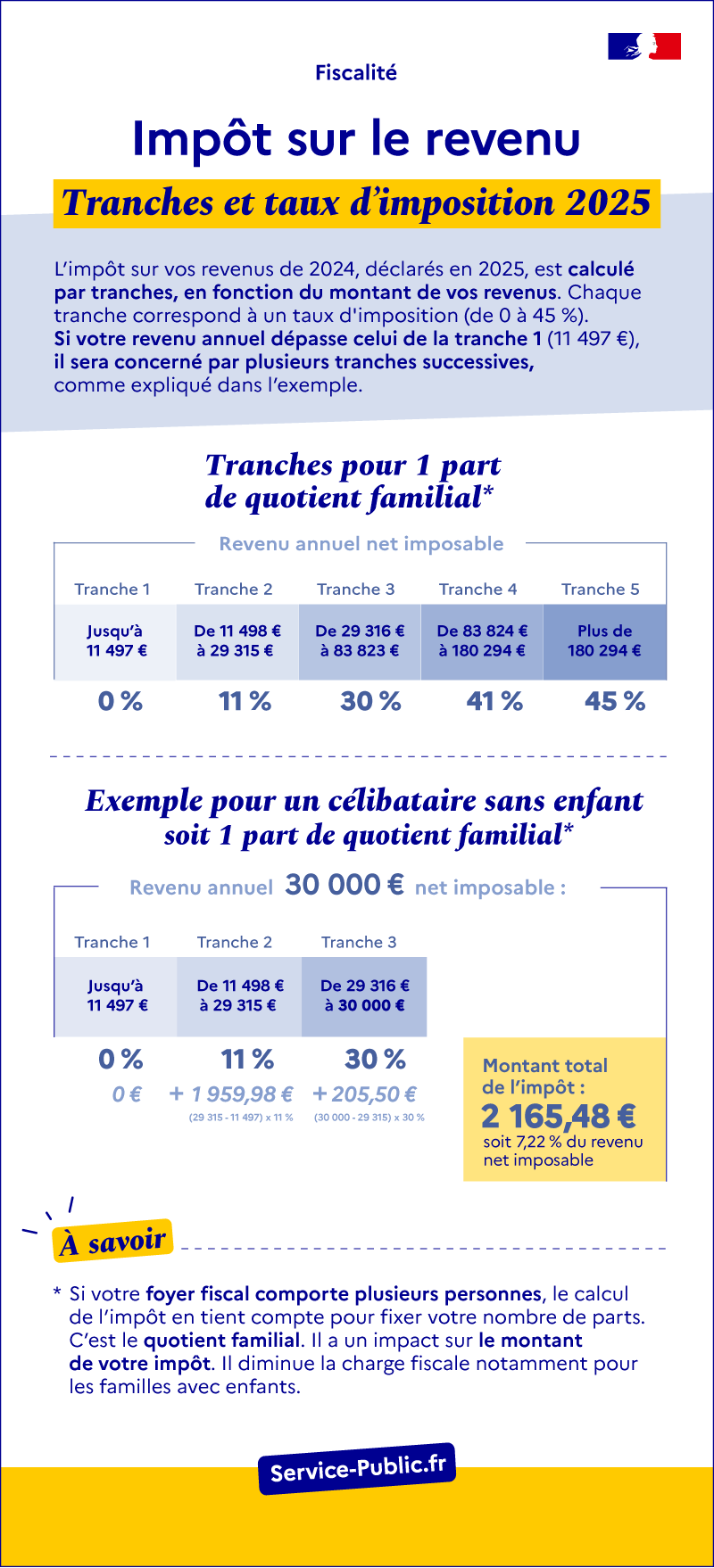

The scale is used to calculate your tax, it is progressive and has several income brackets, each corresponding to a different tax rate, which varies from 0% to 45%.

Tax scale To apply the PTA to your taxable income, you need to take into account the family quotient, that is, your number of shares, which depends on your situation (single, married, etc.) and the number of dependants.

Tax scale The target is set annually. The 2025 schedule (applicable to 2024 income) is set by the 2025 budget law. Thresholds are raised by 1.8% in 2025.

Infographie - Tax brackets and rates in 2025

Ouvrir l’image dans une nouvelle fenêtre

For more information, see the backgrounder Tax scale What is the income tax?

Additional topics

Ministry of Economy

Ministry of Economy

Agenda

À partir du 12 avr. 2025

Sécurité alimentaire

Publié le 16 avril 2025

À partir du 10 avr. 2025

Impôts 2025

Publié le 10 avril 2025

Du 14 avr. au 15 juin 2025

Prévention

Publié le 02 avril 2025