Energy check (gas, heat, electricity)

Verified 14 May 2024 - Directorate for Legal and Administrative Information (Prime Minister)

Newly eligible persons in 2024

Individuals whose income and household composition in 2022 allows them to be eligible for the 2024 energy check (RFR/CPU less than €11,000), can apply for an energy check until December 31, 2024 on a dedicated portal.

It is possible to verify its eligibility for the 2024 energy check by using a simulator.

Would you like to obtain financial assistance to pay your energy costs (electricity, gas...) or carry out some energy renovation work in your home? You can benefit from the energy check if you meet certain conditions. We show you how to take advantage of them and how to use them.

The energy check helps you pay for the following expenses:

- Expenditure on energy supply related to housing (electricity bills, gas ...)

- Purchases of fuel (electricity, natural gas or liquefied oil, domestic fuel oil, wood, biomass or other fuels for heating or hot water production)

- Energy charges included in the charge if you are staying in a home contracted, or in an establishment (Ehpad or EHPA), independent living, long-term care facility or unit (LTCF or LTCF)

- Recoverable charges including energy costs receipts for social housing

- Expenditure related to the acquisition or installation of equipment, materials and apparatus eligible for the scheme MaPrimeRenovate'. They must imperative be carried out by a professional recognized guarantor of the environment (EGR).

Search for a company with the quality "Recognized Guarantor of the Environment"

Warning

The energy check is not a bank check. It is not cashable from a bank.

Ouvrir l’image dans une nouvelle fenêtre

Energy check

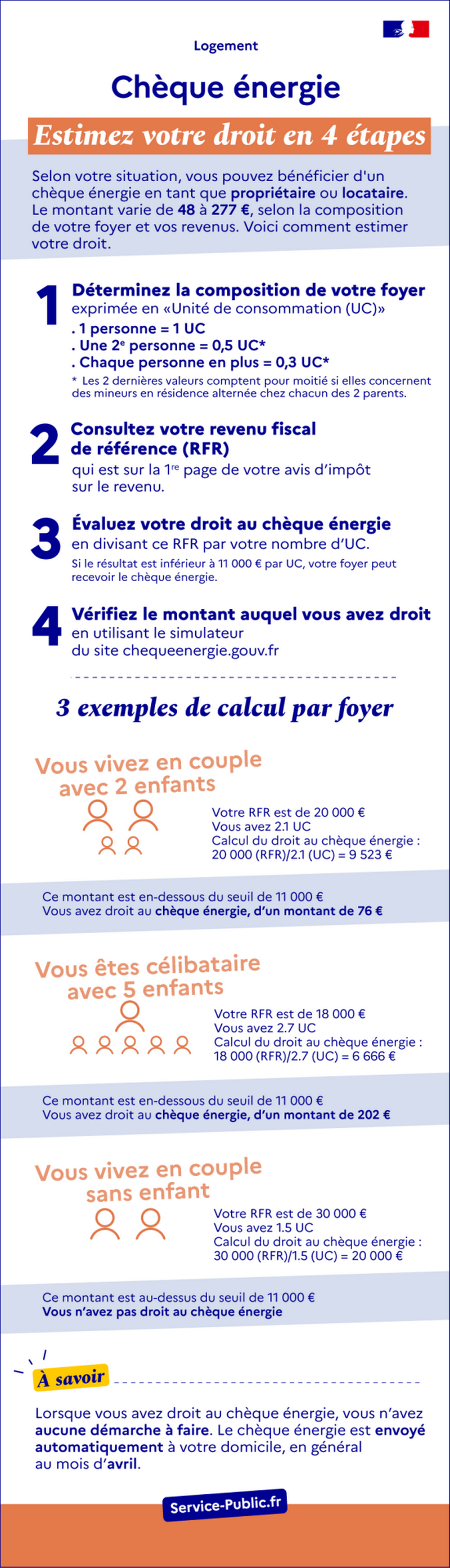

Estimate your right in 4 steps

Depending on your situation, you can benefit from an energy check as owner or tenant. The amount varies from €48 to €277, depending on your household composition and income.

1. Determine the composition of your household expressed in "Consumption Unit (CPU)"

- 1 person = 1 CPU

- A 2nd person = 0.5 CPU*

- Each person more = 0.3 CPU*

*The last 2 values count for half if they concern minors in alternate residence in each of the 2 parents.

2. View your reference tax income (RFR) that is on the 1re page of your income tax notice.

3. Evaluate your entitlement to the energy check by dividing this RFR by your number of CPUs.

If the result is less than €11,000 per CPU, your household can receive the energy check.

4. Check the amount to which you are entitled by using the simulator of the website chequeenergie.gouv.fr

3 examples of calculation per focus

Example 1:

You live as a couple with 2 children

Your RFR is €20,000

You have 2.1 CPUs

Calculation of entitlement to the energy check:

20 000 (RFR) / 2,1 (UC)= € 9 523

This amount is below the threshold of €11,000

You are entitled to the energy check, for an amount of 76 €

Example 2:

You're single with five kids

Your RFR is €18,000

You have 2.7 CPUs

Calculation of entitlement to the energy check:

18 000 (RFR)/2,7 (UC)= € 6 666

This amount is below the threshold of €11,000

You are entitled to the energy check, for an amount of 202 €

Example 3:

You live as a couple without children

Your RFR is €30,000

You have 1.5 CPUs

Calculation of entitlement to the energy check:

30 000 (RFR)/1,5 (UC) = 20 000 €.

This amount is above the threshold of €11,000

You're not entitled to the energy check

Did you know that?

When you are entitled to the energy check, you do not have to take any steps.

The energy check is automatically sent to your home, usually in April.

Service-Public.fr

The energy check is allocated means-tested.

To determine your entitlement to the energy check, you must check 3 settings :

- Know the composition of your household expressed in "Consumption Unit" (CPU) knowing that 1 person in the household = 1 CPU, one 2e person = 0.5 CPUs and each additional person = 0.3 CPUs. These last 2 values account for half if they concern minors in alternate residence in each of the 2 parents.

- Consult your reference tax income (RFR) (N-2 ) on your tax or non-tax notice

- Divide this RFR by your CPU count. This will help you determine if your RFR is below the threshold of €11,000 per CPU. Thus, if the result is less than €11,000 by UC, your home can receive the energy check.

The amount of the energy check is at least €48 and up to €277 TTCTTC : All taxes included.

Number of persons living in the household | RFR less than €5,700 per CPU | RFR of €5,700 to €6,800 per CPU | RFR of €6,800 to €7,850 per CPU | RFR of €7,850 to €11,000 per CPU |

|---|---|---|---|---|

1 person (corresponds to 1 CPU) | €194 | €146 | €98 | €48 |

2 people (corresponds to 1 CPU + 0.5 CPU) | €240 | €176 | €113 | €63 |

3 or more people (corresponds to 1 CPU + 0.5 CPU + O.3 CPU for each additional person) | €277 | €202 | €126 | €76 |

You can do an online simulation to see if you are affected by the energy check and its amount:

Auto Assign

You have no no steps to take. The tax authorities are responsible for determining the list of persons who meet the conditions for allocation on the basis of the tax returns.

This list shall be forwarded to the Payment and Services Agency (PSA). It's the PHA that sends the energy check to the people who are affected.

Non-receipt of energy check

When you have not received your energy check due to your absence from the beneficiary file because you did not file your income tax return or sent it out of time, you must file a claim with the ASP.

To be admissible, your complaint must be made before 31 December the year following the year in respect of which the energy check was issued or should have been issued. After this date, and in the absence of any reaction on your part within 3 months following the date of the last communication sent by the ASP, your complaint in progress is finally closed.

The ASP reviews your file on the basis of the information provided to it. If the criteria are met, the ASP grants you the benefit of the energy check.

FYI

Written information is sent to remind you of the need to fulfill your tax obligations within the legal deadlines. It also indicates that a claim for the same reason will not be admissible in subsequent years.

When your situation, with regard to the tax administration, is corrected and whether this correction allows you to meet the conditions to benefit from the energy check or entitles you to a higher amount, the ASP issues, as the case may be, a supplementary energy check or exchanges the check initially received for a new check.

The energy check is sent by post once a year to your home (home or residential home or establishment).

The shipment is made in the month ofApril.

It depends on the nature of the expenditure.

Répondez aux questions successives et les réponses s’afficheront automatiquement

Energy Bills

To pay a bill, you don't have to wait for your next bill. You have 2 possibilities :

- You pay online on the energy check site by entering your check number, scratch code, customer references

- You send your energy check by simple mail to your supplier. You must attach a copy of a recent invoice or schedule showing your customer references.

You can also request that your energy check be directly deducted of your invoice by your supplier.

This request can be made in two ways:

- Either online on the energy check site

- Or by checking the red box on your energy check before sending your check by simple mail to your supplier

You will no longer have to go through the next few years to use your energy check on this same contract if you are still entitled to the check.

FYI

If the amount of your energy check exceeds your next invoice, the amount of the remaining check will be automatically deducted from subsequent invoices.

In case of unpaid invoices, the value of the check shall be deducted, in order of priority, from the old invoices, then, if the amount of the check so permits, from the invoice following receipt of the check, and finally from the following invoices.

If you have opted to pay your invoices by monthly payment, your supplier deducts the check value from the 1re upcoming monthly payment, and the following monthly payment or payments if the 1re monthly is less than the check amount. If this is the case, the remaining amount is deducted from the adjustment invoice.

Energy loads in a dwelling or home

To pay your energy charges included in your royalty, you must remit your energy check directly to your home manager or institution.

FYI

Where the value of the energy check exceeds the amount payable, the overpayment shall be allocated to the following installment(s).

The overpayment can only be paid to you at the end of your contract of occupation.

Purchase of fuel

To pay for your fuel purchase, you must remit your energy check directly to your supplier.

FYI

If the amount of your energy check exceeds your invoice, there is no change.

Recoverable charges including energy costs

Your social landlord can deduct the amount of the energy check in full from the next receipt even if the monthly amount of energy-related expenses is less than the amount of the energy check.

If the value of the energy check is greater than the amount of these charges, the overpayment is deducted from the following receipt(s). In the event of termination of the lease, the overpayment is repaid to you.

Work or energy expenditure for your home

You can pay your construction bill directly with your energy check at the EGR company you have chosen.

Search for a company with the quality "Recognized Guarantor of the Environment"

Vous avez choisi

Choisissez votre cas

Energy Bills

To pay a bill, you don't have to wait for your next bill. You have 2 possibilities :

- You pay online on the energy check site by entering your check number, scratch code, customer references

- You send your energy check by simple mail to your supplier. You must attach a copy of a recent invoice or schedule showing your customer references.

You can also request that your energy check be directly deducted of your invoice by your supplier.

This request can be made in two ways:

- Either online on the energy check site

- Or by checking the red box on your energy check before sending your check by simple mail to your supplier

You will no longer have to go through the next few years to use your energy check on this same contract if you are still entitled to the check.

FYI

If the amount of your energy check exceeds your next invoice, the amount of the remaining check will be automatically deducted from subsequent invoices.

In case of unpaid invoices, the value of the check shall be deducted, in order of priority, from the old invoices, then, if the amount of the check so permits, from the invoice following receipt of the check, and finally from the following invoices.

If you have opted to pay your invoices by monthly payment, your supplier deducts the check value from the 1re upcoming monthly payment, and the following monthly payment or payments if the 1re monthly is less than the check amount. If this is the case, the remaining amount is deducted from the adjustment invoice.

Energy loads in a dwelling or home

To pay your energy charges included in your royalty, you must remit your energy check directly to your home manager or institution.

FYI

Where the value of the energy check exceeds the amount payable, the overpayment shall be allocated to the following installment(s).

The overpayment can only be paid to you at the end of your contract of occupation.

Purchase of fuel

To pay for your fuel purchase, you must remit your energy check directly to your supplier.

FYI

If the amount of your energy check exceeds your invoice, there is no change.

Recoverable charges including energy costs

Your social landlord can deduct the amount of the energy check in full from the next receipt even if the monthly amount of energy-related expenses is less than the amount of the energy check.

If the value of the energy check is greater than the amount of these charges, the overpayment is deducted from the following receipt(s). In the event of termination of the lease, the overpayment is repaid to you.

Work or energy expenditure for your home

You can pay your construction bill directly with your energy check at the EGR company you have chosen.

Search for a company with the quality "Recognized Guarantor of the Environment"

Your energy check is valid until 31 March of the year following its issue.

Its effective date is written on the check.

Yes, the energy check is stackable with the help MaPrimeRenovate'.

You must report the loss of your energy check directly online or by phone:

Who shall I contact

Energy check

Support center to answer all your questions about the energy check

By telephone

08 05 20 48 05

Open from Monday to Friday from 8am to 8pm.

Free service and call

By email

By accessing the contact form.

You will need to specify the following:

- Your name

- Your first name

- Your tax number (listed on your tax notice)

- Your address

- And, if possible, the check number (indicated on the stub of the check letter).

Who can help me?

Find who can answer your questions in your region

Energy check

Support center to answer all your questions about the energy check

By telephone

08 05 20 48 05

Open from Monday to Friday from 8am to 8pm.

Free service and call

By email

By accessing the contact form.

Conditions of award

Conditions of award

FAQ

Service-Public.fr

Service-Public.fr

Ministry of Housing

National Institute of Consumer Affairs (INC)